- You are here

- Home

- Guide to Africa

- African Travel Articles

- Choosing the correct travel insurance policy for travel in Africa

Choosing the correct travel insurance policy for travel in Africa

INTRODUCTION

Death in paradise?

Lost your phone deep in the Sahara?

Fell down Kilimanjaro?

......I’m your man

Step-by-step on finding the cheapest and most suitable travel insurance for your African holiday

Africa is one of the most fascinating continents in the world. From the breathtaking wildlife, to the intriguing culture, Africa won’t let you down. It would be advisable to purchase travel insurance after you have booked your trip as there are dangers when travelling in Africa, just like any place you travel to.

For example, you may catch an illness or hurt yourself exploring a Cape Town. Your insurance can then cover the costs for you if you do purchase the correct policy.

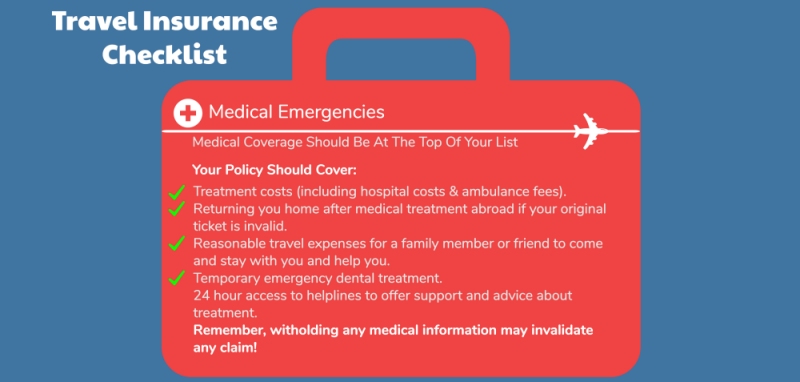

We have our very own travel insurance checklist so that you can instantly be prepared to find the plan that you’ve been dreaming about!

PRECAUTIONS

Before you consider any type of travel insurance when visiting Africa, you must take some precautions to ensure you choose the best plan.

● You may already be covered:

- Many bank accounts that charge a monthly fee offer a few handy benefits; one of which is often travel insurance.If you believe you apply to this, check your bank account terms to see if it applies to your trip. It takes two minutes!

● Pre-trip illnesses:

- If you have booked your African holiday in advance and have left buying travel insurance in the ‘back burner’ as your holiday isn’t for another 8 months, you’re doing it wrong

- You should purchase your travel insurance immediately after booking your holiday as anything can happen regarding your health in the time between now and your trip. Purchasing the insurance immediately after will allow you to be covered for any issues that may occur before your trip AND cover you for any cancellations

- Different insurance companies vary their terms slightly, so be sure to check them out

- A small add-on to this point is to ensure all medical conditions are declared when you purchase your travel insurance. This is due to travel insurance claims being rejected as people’s medical conditions were not clearly declared when the travel insurance was purchased.

● Group Plans

If you are travelling in a group or with a family, you should double check the group/family plan equates to less than if you bought your insurance individually…These companies can be cheeky at times!

● For all of you wine drinkers

- If you have had even just one alcoholic drink and lose an item when you fell off an Elephant (you wouldn’t be laughing it was you!), your insurance usually won’t cover you!

- Companies range in their Terms & Conditions. Some may state they won’t cover you if alcohol has affected your decision-making ability and some may be more accurate and state they won’t cover you if you have had four or more pints of Lager.

- We all have different alcohol tolerances so one drink may invalidate a claim.

TYPES OF PLANS

Check For Your Best Suited Policy When Travelling To Africa Read on to understand what policy best suits you!

When you have spent weeks, if not months planning and booking your African holiday, travel insurance can seem like a long-winded process to try and find the right plan for your trip; deterring you away from purchasing.

This is why we have constructed this article… for your ease!

Let’s get this section started:

Annual Multi-Trip Policies

This policy is designed for multiple trips to Africa within a 12 month period which often works out cheaper than buying multiple Single-Trip plans..

Here’s the catch:.

Companies differ in their Terms and Conditions in all aspects, but the one you will want to focus on is the number of days your insurance will last.

Who is best suited for this plan?

This policy suits anyone who plans to travel to Africa more than 3 times a year. If you are in a group, couple or family, you may want to check out the other plans listed below.

What does this plan cover?

Typically, this plan will cover medical, cancellation/delay or loss of luggage issues. You will need to check the Terms and Conditions of the provider you choose as each company varies their terms

Single-Trip Plan

The Single-Trip Plan is specifically designed for anyone who is considering just one trip to Africa (pretty self-explanatory I know).

Again, if you are in a group, couple or family, you may want to check out the other plans listed below.

What does this plan cover?

Usually, the best companies cover any emergency medical issues, legal expenses, lost or stolen property including passport and money and finally any charges incurred if you have to abandon or cancel your trip.

Worldwide Plan

This plan is perfect for you guys as it is for people who are travelling outside of their home continent. What does this plan cover? Coverage may vary from company to company, but this plan will typically cover all medical emergency costs, cancellations, delays, lost or stolen luggage and more.

Family Plan

Usually designed for a family of two adults and a child. If a child is under 18 years old, they may be covered for free when using the family plan.

You are usually covered for up to £10m in medical expenses and you may have access to a 24/7 medical emergency line.

Be sure to check terms and Conditions before purchase to view variances.

Group Plan

This plan is suited for a group of friends travelling to Africa together.

You will typically have coverage of up to 10 people with your typical cover of medical expenses, lost or stolen property and delays/cancellations.

Over 65’s

This plan is quite self-explanatory… aimed at people aged 65+.

This plan can be merged with any of the above plans. However, will likely be more expensive as companies typically view a person over the age of 65 to be at higher risk of emergencies.

You will likely have slightly more coverage than a typical plan in regards to medical expenses.

When purchasing any travel insurance as a group, remember that the price varies as the company will always take into account the age of the eldest member. So, the price will usually be dictated from that.

| If you want: | Include this in your Policy |

| Payment for expenses if you get ill or injured on a trip | Travel medical and accident coverage |

| To be taken to the nearest hospital or flown home if necessary | Emergency evacuation and repatriation |

| Reimbursement if you get ill and have to cancel or end your trip early | Trip cancellation AND trip interruption |

| Payment for lost, stolen or damaged luggage or goods | Theft and lost coverage |

| Help finding a doctor abroad | 24-hour assistance |

| Payment for rental car damage | Car collision insurance (CDW) |

Author: Ollie Birk - a Content Manager at Flight Delay Claims Team. He is a travel-addict and is an admirer of the African cultures. His favourite location in Africa is Sharm-El-Sheik, Egypt and enjoys Scuba Diving there.